california mileage tax bill

Please contact the local office nearest you. Posted on January 10 2021 1101 pm.

California Issues Emergency Regulation To Clarify Marketplace Facilitator Act

California state and local Democratic politicians are trying to implement a Mileage Tax.

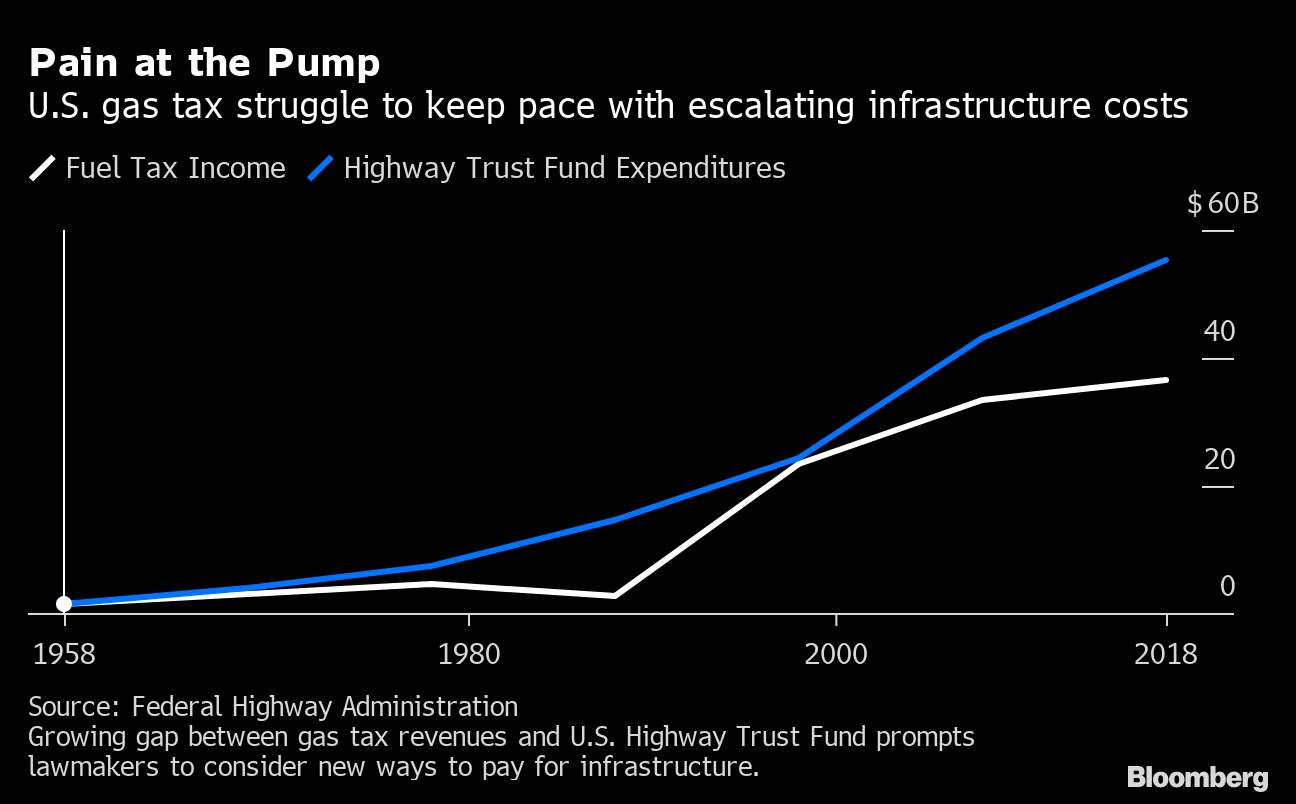

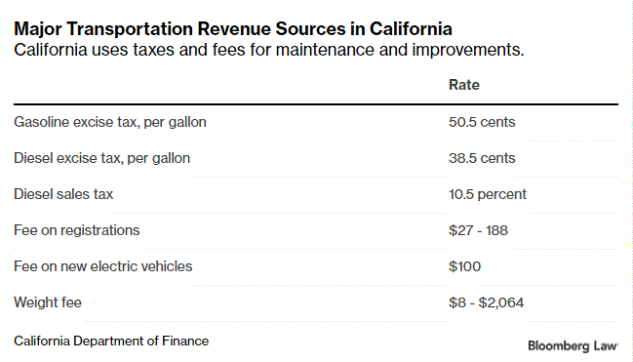

. The average Prius owner would pay the state 11666 the difference between the 19443 in road usage. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. California has announced its intention to overhaul its gas tax system.

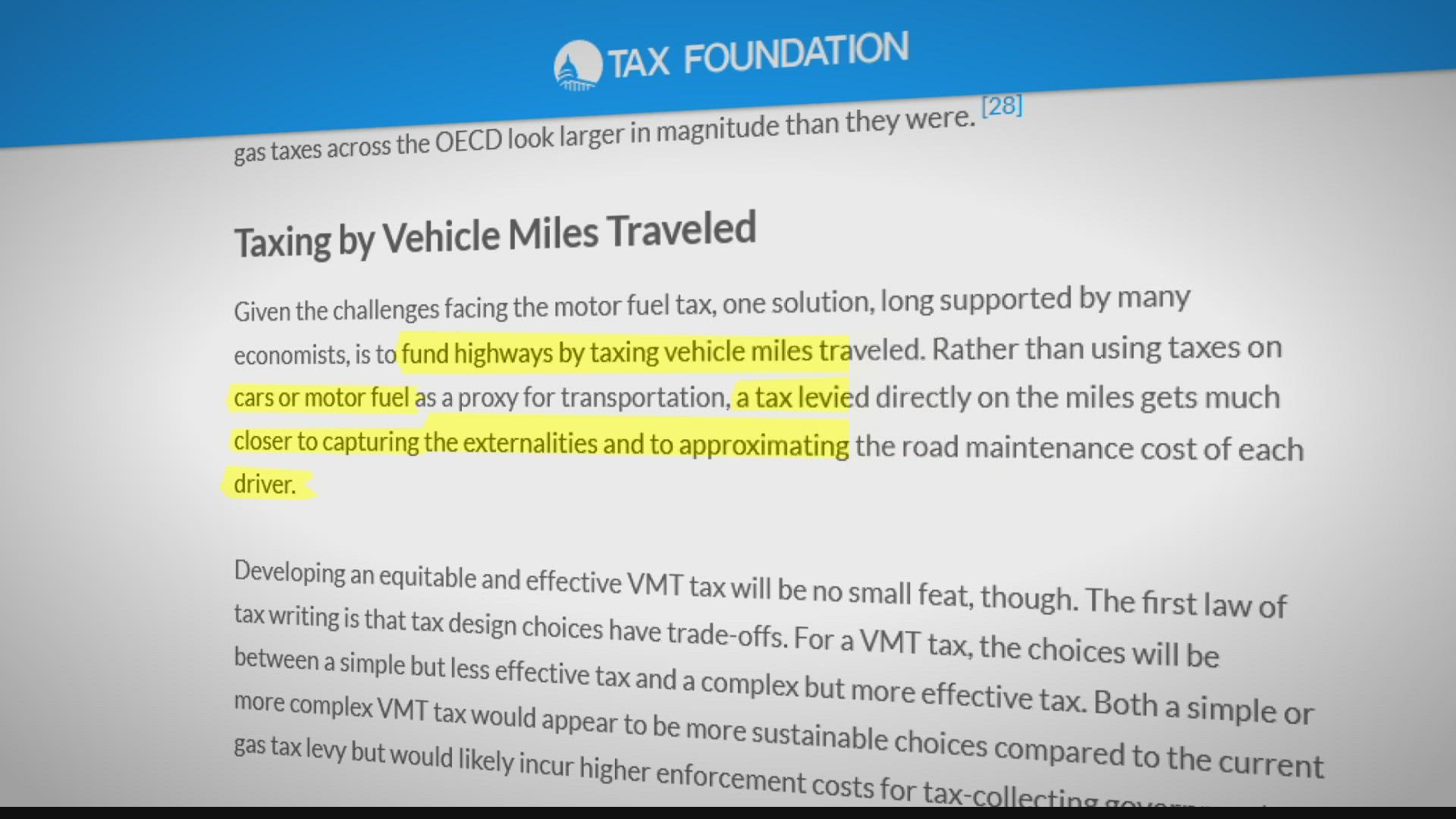

The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as. Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric vehicles be. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Senator Wiener Introduces SB 339 to Extend Californias Road Charge Pilot Program Providing a Potential Future Source of Transportation and Road Funding. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled. The California legislature passed a bill extending a road usage charge pilot program.

10 They both increased. October 1 2021. The bill would require.

California Expands Road Mileage Tax Pilot Program. Californias Proposed Mileage Tax. California Mileage Tax.

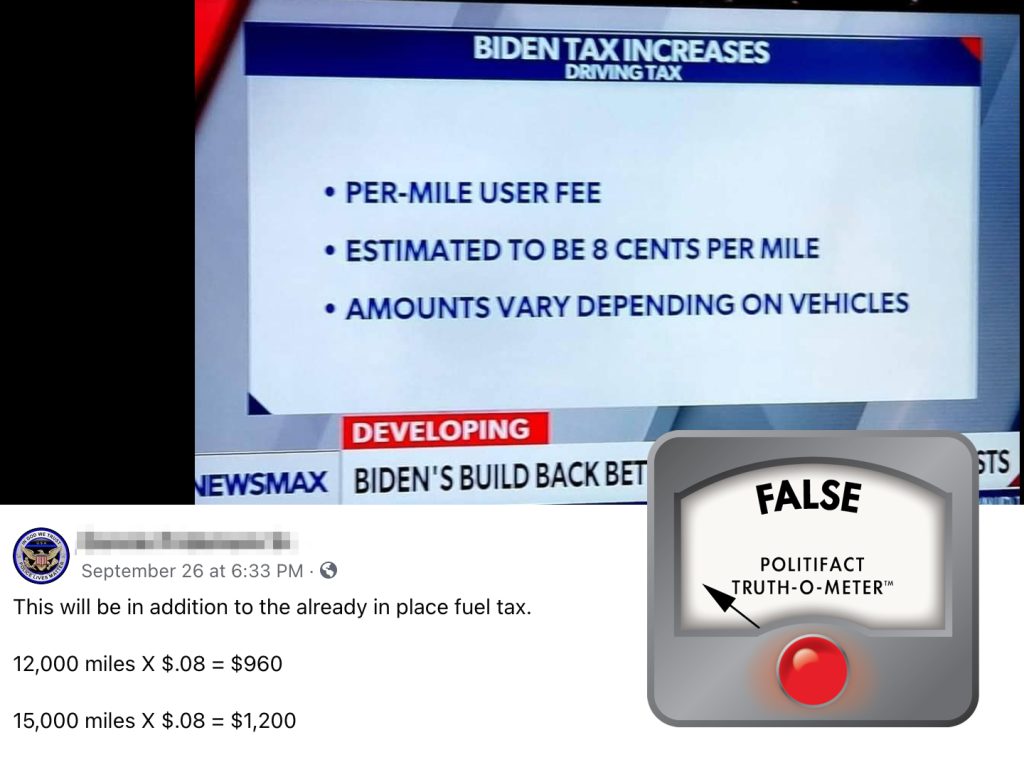

California mileage tax bill Tuesday June 14 2022 Edit. Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos Politifact Biden Infrastructure. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

2 billion in relief for free. This means that they levy a tax on. Registered vehicle owners in California will be eligible for at least 400 per vehicle totaling 9 billion in direct payments to millions of Californians.

California Expands Road Mileage Tax Pilot Program. But opponents are concerned the legislation is laying the groundwork for a. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

For questions about filing extensions tax relief and more call. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. The annual road usage tax due for both drivers would be 19443.

Since 2015 the program allows the state to study a road. For the final 6. For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile.

Online videos and Live Webinars are available in lieu of. California wants to tax your road mileage. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according.

Traditionally states have been levying a gas tax. Traffic flows past construction work on eastbound Highway 50 in Sacramento California. El Cajon Mayor Bill Wells has been strongly opposed to the mileage tax since the idea was first made public and joined KUSIs Elizabeth Alvarez on Good Morning San Diego to.

Replace Gas Tax With More Efficient Fairer Mileage Fee Orange County Register

Infrastructure Plan Biden Rejects Gas Tax Mileage Fee To Pay For It

What S Easier Killing Aliens Or Levying A Vehicle Mileage Tax Tax Policy Center

Us California Exploring Vehicle Miles Traveled User Fee To Replace Gas Tax

All About Bills Of Sale In California The Facts And Forms You Need

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Town Hall Organized To Fight Against Sandag S Mileage Tax Hikes Cbs8 Com

Supervisor Jim Desmond Suspend California S Gas Tax For One Year

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

Under Proposed Mileage Fee Truckers Could Save 33 But Cars Would Pay Three Times More Pittsburgh Post Gazette

Biden Infrastructure Bill Is There A Mileage Fee Wusa9 Com

Verify Does Infrastructure Bill Include Per Mile User Fee Wthr Com

Fact Check No Driving Tax Of 8 Cents Per Mile In Infrastructure Bill

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Infrastructure Package Includes Vehicle Mileage Tax Program

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Half Of Americans Want Drivers Who Drive More To Pay More Streetsblog Usa

Publication 970 2021 Tax Benefits For Education Internal Revenue Service